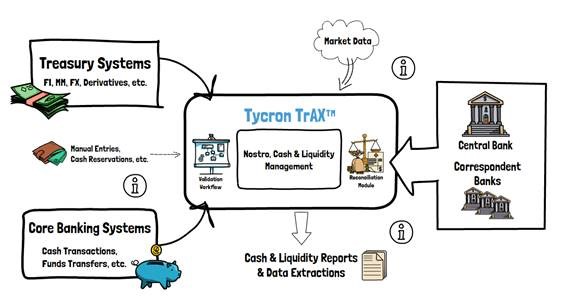

Cash & Liquidity Management

Our Cash & Liquidity Management modules provide an institution with the necessary tools and functionalities for a more efficient and controlled cash management process; a real time overview of all cash positions, cash movements and projected cash flows across all accounts, along with liquidity updates and risk evaluation, liquidity ratios and the right set of reports, will all enable the institution to meet its financial obligations in different market conditions